Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

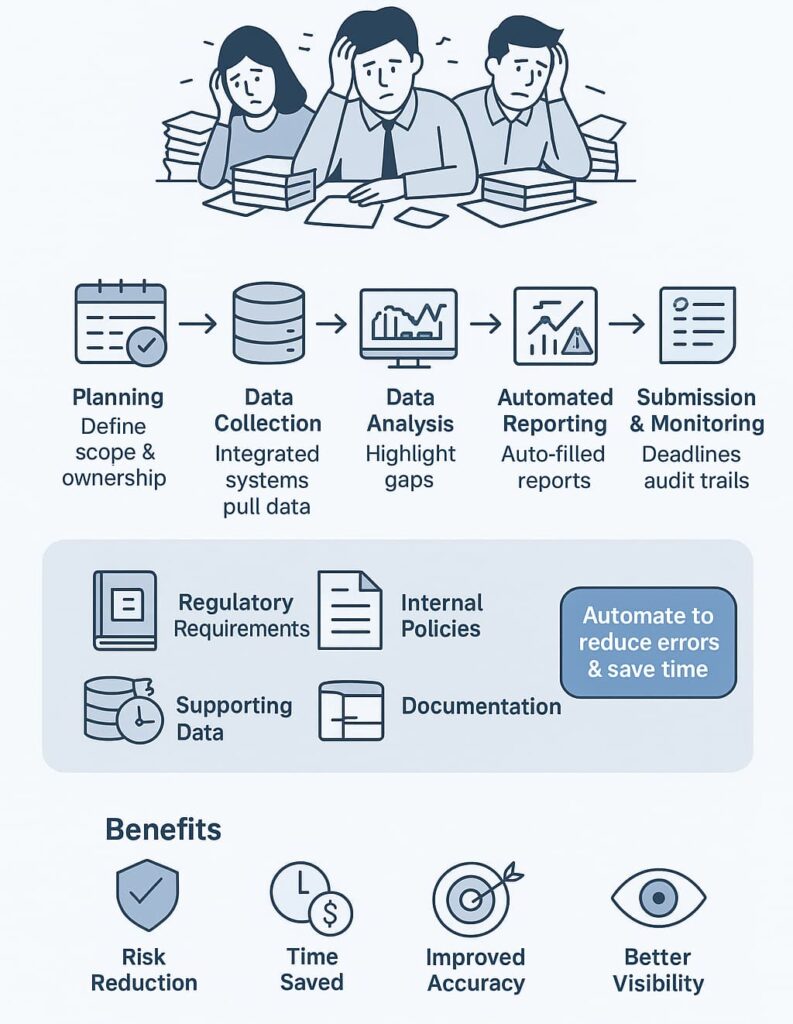

Stacks of paper scattered everywhere. Coffee stains on regulatory forms. Three different versions of the same report, and nobody knows which is current. Yeah, compliance reporting is a mess for most companies.

The usual problem? Too much manual work, not enough time. Teams end up scrambling at the last minute, copying numbers between files at 2 AM, hoping they didn’t mess up somewhere. It’s exhausting, and frankly, dangerous for business.

There’s a better way to handle this chaos, without burning out your staff or risking major mistakes.

Want to stop dreading compliance season? Read on for simplifying compliance reporting process.

Most security providers struggle with juggling multiple regulatory frameworks. The pressure builds as teams rush to meet deadlines, often working late into the night fixing spreadsheet errors. We’ve watched countless MSSPs burn through staff who quit after months of mind-numbing compliance tasks.

Organizations face real consequences when compliance goes wrong:

Our work with MSSPs reveals a common thread, manual compliance drains resources better spent on protecting clients. When providers streamline these processes, we see immediate improvements. Teams catch issues early, audits run smoother, and everyone sleeps better knowing nothing slipped through the cracks.

The key is shifting from reactive to proactive compliance. Having spent years helping MSSPs evaluate security products, we understand what works. Smart automation and clear workflows make compliance manageable, not perfect, but significantly better than the chaos of manual tracking. [1]

No MSSP can escape the basics, compliance starts with knowing what rules matter. After years of guiding security providers, we’ve learned that rushing past fundamentals leads to costly mistakes later.

Four critical pieces make up any solid compliance program:

These building blocks form the base for simpler compliance reporting. Understanding the fundamentals of basic compliance reporting ensures every MSSP builds a strong foundation that keeps processes efficient and consistent. Miss one, and the whole system becomes shaky.

Credits: TheComplyGuide

A solid plan is the foundation of any successful compliance effort. Here’s what we recommend:

From our experience at MSSP Security, clarity at this stage prevents confusion down the line and makes automation more effective.

Collecting and validating data manually is a common bottleneck. To simplify:

Automated workflows here not only save time but also build trust in the data’s reliability, a critical factor for audit readiness.

Gathering data is just one piece of the puzzle. Understanding what it means is crucial.

This proactive approach ensures issues get addressed early, reducing the risk of regulatory penalties.

Reports should be a byproduct of your data and analysis, not a manual chore.

For example, generating a HIPAA compliance report by automatically integrating patient record data streamlines what used to be a cumbersome manual process.

Finally, managing submissions and follow-ups ensures nothing falls through the cracks.

Continuous monitoring here closes the loop, supporting a culture of ongoing compliance rather than intermittent checks. Maintaining audit-ready reports throughout the year helps teams stay prepared instead of scrambling only when deadlines hit.

Technology plays a key role in simplifying compliance workflows. Here’s what we’ve found essential:

At MSSP Security, we rely on integrated solutions that combine these capabilities, enabling clients to accelerate compliance while minimizing manual work.

Compliance is not a one-time project; it’s a continuous journey.

By doing so, organizations maintain their edge and reduce the likelihood of surprises during audits. [2]

Putting these steps and tools into practice results in:

Our experience at MSSP Security confirms these benefits consistently translate into stronger security postures and greater stakeholder confidence.

Compliance automation streamlines repetitive tasks like data validation, compliance evidence collection, and report generation. Automated workflows and compliance dashboards make it easier to track regulatory requirements and audit readiness.

This approach improves accuracy, shortens reporting cycles, and allows compliance teams to focus more on risk assessment and continuous monitoring rather than manual documentation.

Effective compliance management ensures all compliance documentation, audit trails, and reporting software are aligned with compliance frameworks.

By using compliance management platforms with automated workflows and audit preparation tools, organizations can simplify evidence mapping and ensure audit readiness without last-minute stress. This helps build consistent reporting accuracy across all regulatory compliance standards.

To improve compliance reporting accuracy, teams can use compliance analytics, compliance reporting templates, and compliance workflow automation. These tools reduce human error, enforce data validation, and standardize reports.

Continuous monitoring and compliance tracking software also support real-time compliance updates, ensuring reports remain consistent and reliable across multiple frameworks and regulatory reporting needs.

Compliance process automation works best when combined with compliance workflow orchestration, compliance control monitoring, and regular risk assessment. Organizations should define compliance standards clearly, automate compliance task management, and integrate compliance data sources.

This creates efficient, transparent reporting cycles that enhance compliance reporting efficiency and ensure long-term regulatory compliance readiness.

Simplifying the compliance reporting process is not just about ticking boxes, it’s about building a resilient, efficient framework that drives growth and trust. By embracing automation, standardization, and continuous monitoring, organizations can turn compliance from a burden into a true competitive advantage.

We’ve walked this path ourselves and invite you to explore how these principles can elevate your operations.

Streamline Your Compliance with Expert MSSP Consulting, Our team offers tailored consulting to help MSSPs optimize tools, enhance visibility, and reduce operational friction. With over 15 years of experience and 48K+ projects completed, we’ll guide you in selecting, integrating, and maximizing the right solutions for your business success.